HPE Acquires Juniper Networks for $14B, Reshaping Networking Industry

The Deal Comes to Fruition: From Antitrust Battles to a "100-Day Show of Strength"

This industry-shaking merger was far from smooth; its progress was constantly overshadowed by regulatory scrutiny. When the deal was officially announced in January 2024, the US Department of Justice initiated a review, citing concerns that it might weaken competition in the AI networking sector, leading to a nearly six-month delay. According to Congressional Forum, HPE and Juniper met with DOJ regulators multiple times in November 2024, promising to open up their technology interfaces in exchange for approval. Finally, on June 28, 2025, the DOJ gave its approval, but with two key conditions: the divestment of the $800 million annual revenue-generating Instant On small business networking business, and the open-sourcing of Juniper's core Mist AI platform code.

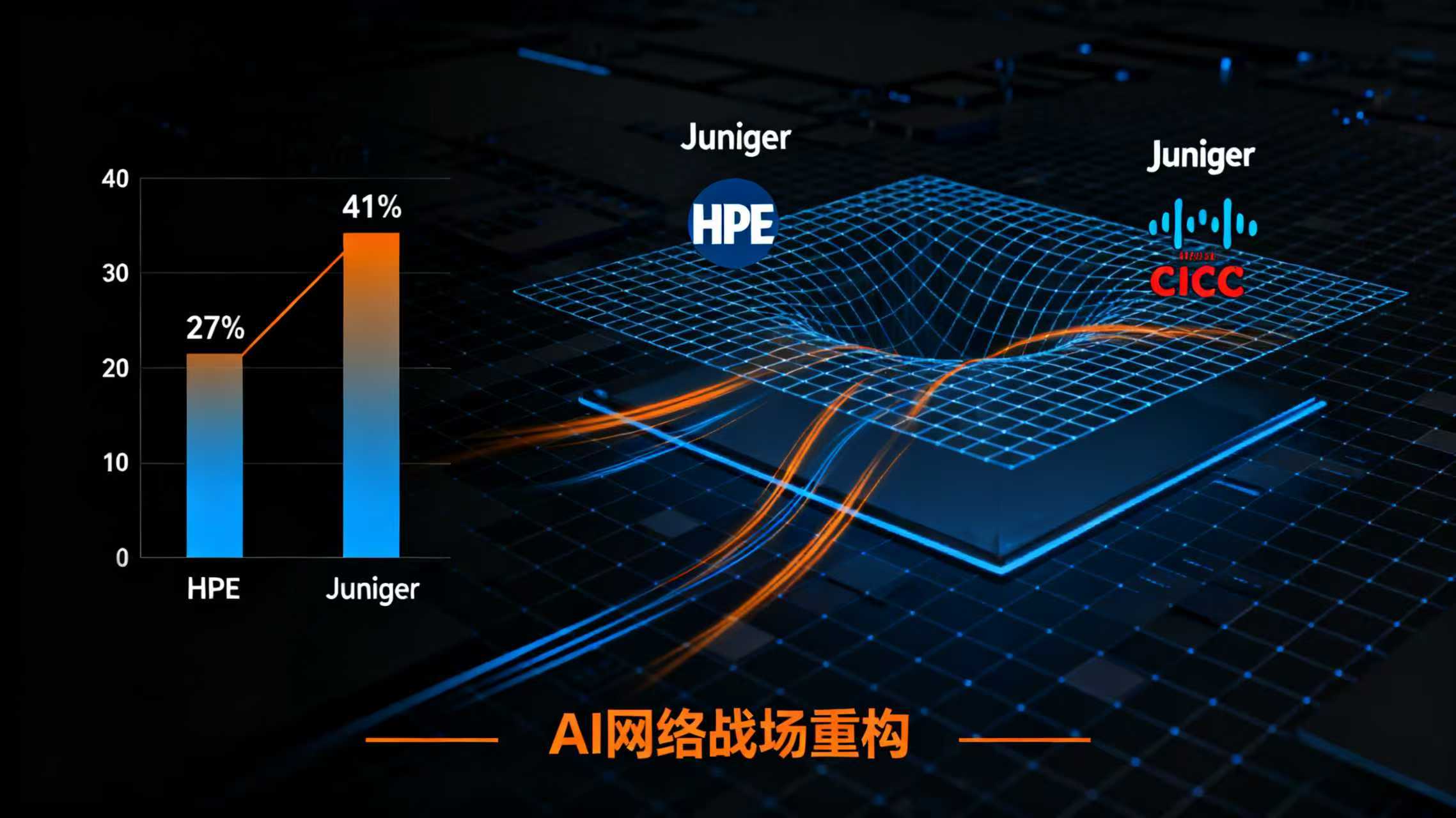

"This is a typical 'technology openness for market access' approach, continuing the regulatory thinking seen in the Broadcom-VMware acquisition," says antitrust lawyer Li Ming. He analyzes that the DOJ was concerned that the merged company would monopolize AI network management technology, and the open-sourcing requirement actually preserved innovation space for the industry. Despite the cost of divesting the business, HPE still views the acquisition as strategically crucial—after the acquisition, its networking business size doubled, and its global market share rose to 27%, second only to Cisco's 41%, making it the first player to fully challenge Cisco in enterprise networking, data centers, and telecom operators.

The integration speed far exceeded market expectations. At Black Hat USA on August 15, HPE unveiled its integrated "weapon": the SASE Copilot intelligent assistant for Aruba EdgeConnect, which uses AI to identify risks such as open ports and unpatched vulnerabilities in real time; and the Aruba Central NAC function, which enables zero-trust policy management across Juniper devices, even covering third-party devices. Even more eye-catching is the upgraded Juniper SRX 4700 firewall, with a throughput of 1.4 Tbps per rack, becoming the industry's first high-end firewall to break the 1Tbps barrier, designed for massive data transmission in AI data centers. At the launch event, David Hughes, Senior Vice President of HPE Networking SASE, stated, “We are redefining the standard for network security in the hybrid cloud era through AI-driven multi-layered protection.” This aggressive approach clearly addresses market concerns—analysts had previously worried that the differing technical architectures of the two brands could lead to a lengthy integration period of up to two years.

Market Shaken: Cisco Faces Its “Strongest Competitor,” Channel Partners Bet on the New Force

The HPE-Juniper merger has triggered a chain reaction in the market, with industry leader Cisco being the first to feel the impact. Data shows that the combined HPE-Juniper entity has annual revenue of $12.6 billion, with $4.9 billion from servers and $1.7 billion from networking, representing year-on-year growth of 16% and 54%, respectively. In contrast, Cisco’s Q3 FY25 earnings report showed its networking business growth slowing to 8%, below the expected 11%.

An even greater challenge comes from customer disaffection. “Cisco customers are incredibly interested in this acquisition; almost every conversation involves questions about the integration progress,” revealed Patrick Shelley, CTO of PKA Technologies, a solutions provider in New Jersey. He added that several Cisco customers are planning to include HPE-Juniper solutions in their 2026 budget cycle for testing, drawn by the “AI-driven simplified management capabilities.” He cited Mist AI’s intelligent diagnostics, which can automatically pinpoint network issues, offering over 10 times the efficiency of manual troubleshooting—a major draw for businesses with lean IT teams.

Channel partner alignment further intensifies the competition. HPE quickly launched a “dual-brand channel integration program” after the acquisition, allowing existing Aruba partners to seamlessly sell Juniper products and offering up to 25% first-order rebates. Shelley revealed that his company has already completed Juniper training for its engineers, noting that “all this investment will be wasted if the deal fails.” This all-in approach reflects strong expectations for the rise of this new force.

Facing this challenge, Cisco has yet to implement any substantial countermeasures. Rumors circulated that Cisco might acquire high-end networking vendor Arista, but analysts pointed out that this plan faced three major hurdles: Arista's open-source SONiC architecture is incompatible with Cisco's proprietary DNA Center system; the combined company would control 75% of the high-end networking market, likely triggering regulatory scrutiny; and Arista's high valuation could deplete Cisco's cash reserves. Cisco is currently responding by accelerating the development of its AI network analytics tool, Cisco AI Network Analytics, but market feedback suggests its functionality still lags behind Mist AI.

Integration Challenges: An $800 Million Revenue Gap and the Technical Integration Test

Despite a promising start, HPE faces numerous challenges in the complex integration process. The most immediate pressure comes from the financial side: the divestment of the Instant On business creates an $800 million annual revenue gap, representing 11% of Juniper's previous revenue. In its latest report, Goldman Sachs warned that if HPE fails to fill this gap with new products by Q4 2025, its stock price could decline by 15%. The difficulty of technical integration is even more uncertain. Aruba excels in enterprise wireless LAN and edge computing, while Juniper specializes in data center core routing and carrier-grade networks; their chip architectures and software protocols are fundamentally different. HPE's proposed solution is to use its GreenLake cloud platform as a "glue," integrating Juniper's routing modules and Aruba's edge management features into a unified interface, but this requires addressing the compatibility of thousands of API interfaces. "What we see now is more feature layering than true technical integration," said Zhang Cheng, IT director of a large financial institution. In his testing of HPE's new solution, Aruba's SASE features and Juniper's firewall still require separate configuration, "The so-called unified management is just a unified interface; the underlying systems remain separate." This falls short of HPE CEO Antonio Neri's promise of "building a unified network platform," raising doubts about the actual effectiveness of the technical integration. The risk of talent loss is also significant. According to LinkedIn data, since the acquisition in July, 12% of Juniper's original core R&D team has left, including key Mist AI algorithm engineers. Despite HPE's promise to retain Juniper CEO Rami Rahim in his current role and offer equity incentives to the core team, cultural differences and divergent development expectations remain difficult to fully overcome.

Redefining the Landscape: Geopolitical Fragmentation and the 6G Standard Dominance Struggle

The impact of this acquisition extends far beyond the corporate level, propelling the global networking industry into an era of geopolitical restructuring. HPE's strategic moves are particularly illustrative: in 2023, it sold its entire stake in H3C, maintaining its presence in the Chinese market through a "technology licensing" model; in 2025, it acquired Juniper to bolster its telecom networking capabilities, forming a "Western technology control + Eastern lightweight asset penetration" framework. This strategy precisely aligns with regulatory requirements in different regions—China recoups H3C's technological sovereignty through capital operations, the EU mandates open API frameworks, and the US enforces open-source technology, with conflicting rules giving rise to new survival strategies.

The contours of regional alliances are gradually becoming clearer. The North American market will see a direct confrontation between HPE-Juniper and Cisco-Arista; Europe will be dominated by Nokia and Ericsson in the O-RAN open-source ecosystem; and the Asia-Pacific region will feature a dual-core structure driven by Huawei and H3C. This fragmentation may lead to a splintering of global networking technology standards, especially in the 6G core network. HPE is betting on Juniper's telecom technology expertise to capture over 15% of the market share, while competitors like Huawei and Ericsson are also accelerating their deployments, with the battle for standard dominance already underway.

For the industry, this acquisition brings not only intensified competition but also technological innovation. HPE sees AI as the key to breaking through, with its agentic AI already capable of predicting and automatically repairing network failures. This "self-driving network" is gradually replacing traditional manual operations. Gartner predicts that by 2027, 60% of large enterprises worldwide will adopt AI-native network architectures, a 40% increase from 2025. The HPE-Juniper combination, if it can achieve technological synergy, is poised to gain an advantage in this transformation. Conclusion: A New Direction for the Industry Amidst the Power Struggle of Giants

The 100-day journey of HPE's acquisition of Juniper Networks is a microcosm of the transformation in the global networking industry—capital reshapes the landscape, technology defines competition, and regulations set the boundaries. Whether the $14 billion investment will yield sustained growth depends on HPE's ability to successfully integrate technologies by the end of 2025 and bridge the revenue gap left by the divestiture of certain businesses. For Cisco, this challenge forces it to abandon its hardware-centric mindset and accelerate AI technology deployment; for Chinese vendors like Huawei and H3C, regional advantages have bought them strategic breathing room. With the advancement of AI infrastructure and 6G development, the growth potential of the networking equipment market continues to expand, but the risks of fragmented standards and geopolitical tensions are also increasing. Whether HPE and Juniper's "marriage" is a success story or a costly lesson remains to be seen. However, one thing is certain: a new era of AI-driven, multi-polar competition, and diversified regulatory frameworks in the networking industry has arrived.